U.S. stock futures are little changed after investors started the week on a positive note amid announcements of exemptions on some U.S. tariffs; Boeing (BA) stock is moving lower in premarket trading after China reportedly ordered carriers to not take deliveries of more jets; Netflix (NFLX) shares are rising on a report that the company revealed rosy financial projections to staff; Bank of America (BAC) shares are gaining after the financial giant topped first-quarter profit and revenue estimates; and Johnson & Johnson (JNJ) reported better-than-expected results and lifted its sales forecast for the full year. Here's what investors need to know today.

1. US Stock Futures Little Changed as Investors Watch Tariffs, Earnings

U.S. stock futures are little changed after indexes rose to start the trading week on news of some tech tariff exemptions. Nasdaq futures are 0.1% higher after the tech-focused index gained 0.6% in the prior session. S&P 500 futures and Dow Jones Industrial Average futures are barely changed after both advanced by 0.8% Monday. Bitcoin (BTCUSD) is up 1% to trade at around $85,500, while the 10-year Treasury yield is ticking higher at near 4.4%. Oil futures are declining while gold futures are up slightly.

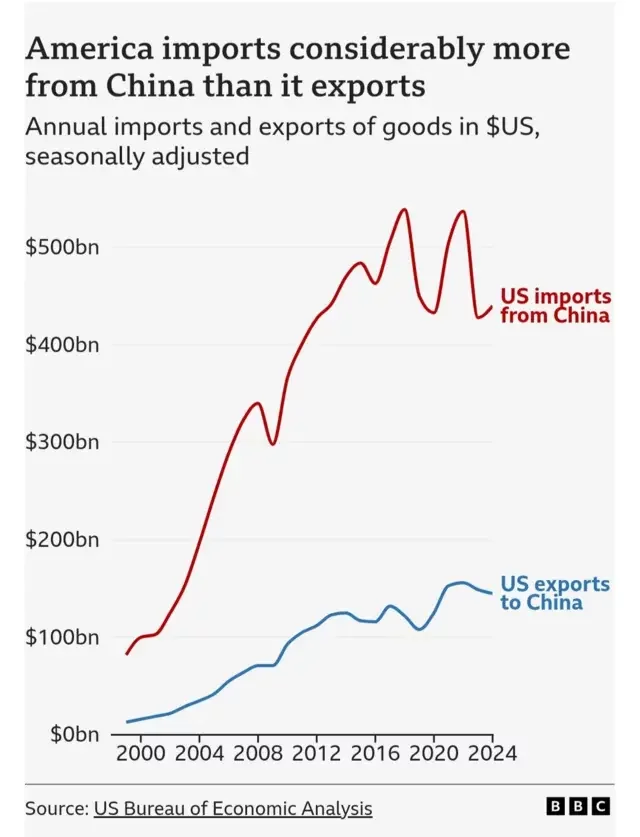

2. Boeing Stock Falls as Beijing Reportedly Forbids Carriers From Accepting Deliveries

Boeing (BA) stock is falling about 3.5% in premarket trading on a report that Chinese officials told its airlines not to take deliveries of the American company's jets amid an escalating trade war with the U.S. After President Donald Trump raised tariffs on Chinese imports to 145%, China responded with a 125% tariff on U.S. products, which Beijing argued now made Boeing planes too expensive, according to a Bloomberg report. China also ordered carriers to halt purchases of U.S.-made parts and equipment, the report said.

3. Netflix Stock Rises on Report of Rosy Financial Projections

Netflix (NFLX) shares are more than 2% higher in premarket trading after a report that the streaming giant has laid out a goal to double its revenue by 2030. The Wall Street Journal reported that executives shared the company's financial goals with senior staff in a meeting, which included reaching a market capitalization of $1 trillion and reaching $9 billion in global ad sales. Netflix, which currently has a market capitalization of around $400 billion, is scheduled to report first-quarter earnings Thursday.

4. Bank of America Stock Gains as Results Surpass Expectations

Bank of America (BAC) stock is rising almost 2% in premarket trading after the financial firm reported better-than-expected quarterly results. The banking giant recorded earnings per share (EPS) of $0.90 on revenue of $27.37 billion. Analysts were projecting $0.82 and $26.80 billion, respectively, per Visible Alpha. CEO Brian Moynihan said the firm is well-positioned to continue growing even "though we potentially face a changing economy in the future." Entering Tuesday, Bank of America shares had lost roughly 17% of their value this year.

5. Johnson & Johnson Tops Estimates, Raises FY Operational Sales Outlook

Johnson & Johnson (JNJ) reported better-than-expected first-quarter results and lifted its operational sales forecast for the full year. The pharmaceutical and medical technology firm posted adjusted EPS of $2.77 on revenue of $21.89 billion, ahead of Visible Alpha consensus estimates of $2.56 and $21.56 billion, respectively. The company lifted its projected 2025 operational sales range to $91.0 billion to $91.8 billion, up from $89.2 billion to $90.0 billion previously. Johnson & Johnson shares are down about 1% in premarket trading after entering Tuesday up about 7% this year.

Comments