Full-scale trade war wit China and US fit hapun afta President Donald Trump sama 125% tariffs on Chinese imports.

China don do dia own too as dem hike dia tariffs - or taxes - on goods wey dey imported from America to 125%.

Wetin dis trade wahala mean for di world economy?

iPhones go cost more becos of Trump tariff on China? 10th April 2025

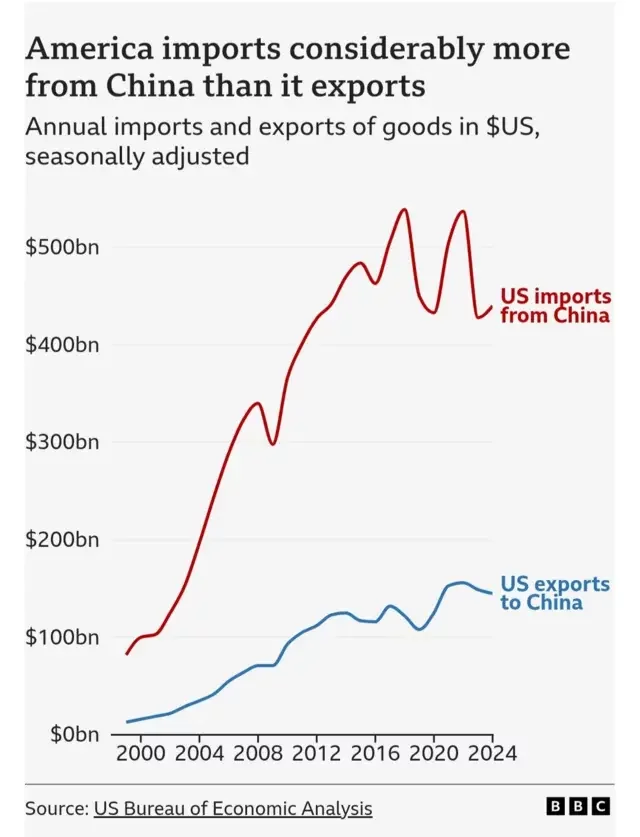

How much trade di two kontris dey do?

Di trade in goods between di two economic powers add up to around $585bn (£429bn) last year.

Although US dey import far more from China ($440bn) pass wetin China dey import from America ($145bn).

Dat leave US to run a trade deficit wit China - dat mean di difference between wetin e dey import and export - of $295bn for 2024. Dat na a considerable trade deficit, equivalent to around 1% of US economy.

But e less pass di $1tn figure wey Trump claim dis week.

Trump already bin impose ogbonge tariffs on China for im first term as president. Dose tariffs bin still dey and im successor Joe Biden add to am too.

Togeda dose trade barriers bin help bring di goods wey US import from China down from a 21% share of America total imports for 2016 to 13% last year.

So US reliance on China for trade don reduce ova di past decade.

Yet analysts dey point out say some Chinese goods wey dey exported to US dem re-route dem through south-east Asian kontris.

For example, Trump administration bin impose 30% tariffs on Chinese imported solar panels for 2018.

But di US Commerce Department bin present evidence for 2023 say Chinese solar panel manufacturers don shift dia assembly operations to states like Malaysia, Thailand, Cambodia and Vietnam and den send di finished products to US from dose kontris, just to boycott di tariffs.

Di new "reciprocal" tariffs wey Trump impose on dose kontris - wey im don pause now - fit push up US price of a wide range of goods wey dey come from China.

Wetin US and China dey import from each oda?

For 2024, di biggest category of goods wey dey exported from US to China na soybeans - dem dey import primarily to feed China estimated 440 million pigs.

US also dey send pharmaceuticals and petroleum to China.

Going di oda way, from China to US, na large volumes of electronics, computers and toys. Dem dey also export large amount of batteries wey dey vital for electric vehicles.

Di biggest category of US imports from China na smartphones, e dey account for 9% of di total. Large proportion of dis smartphones na made in China for Apple, one US-based multinational company.

US tariffs on China na one of di main contributors to di decline for di market value of Apple in recent weeks, dia share price don fall by 20% ova di past month.

All dis imported items to US from China already dey set to dey more expensive for Americans sake of di 20% tariff wey Trump administration don already impose on Beijing.

Now wey di tariff don rise to 125% - and even 145% for some products - di impact fit dey six times greater.

And US imports into China go also go up in price due to China retaliatory tariffs, ultimately dis go hurt Chinese consumers in a similar way.

But beyond tariffs mata, e get oda ways for dis two nations to attempt to damage each oda through trade.

China get central role for refining many vital metals for industry, from copper and lithium to rare earths.

Beijing fit put obstacles in place for dis metals to reach US.

Dis na somtin wey dem don do already in di case of two materials wey dem dey call germanium and gallium, wey military dey use for thermal imaging and radar.

As for US, dem fit attempt to tighten di technological blockade on China wey Joe Biden bin start - dem go make am harder for China to import di kind of advanced microchips - wey dey vital for applications like artificial intelligence - wey dem still neva fit produce by diasef.

Donald Trump trade advisor, Peter Navarro, bin tok dis week say US fit apply pressure on oda kontris, including Cambodia, Mexico and Vietnam, not to trade wit China if dem wan kotinu to export to US.

How dis fit affect oda kontris?

US and China togeda account for a large share of di global economy, around 43% dis year according to di International Monetary Fund.

If dem wan engage in an all-out trade war to slow dia growth down, or even push dem into recession, dat go likely harm oda kontris economies in di form of slower global growth.

Global investment go also likely suffer.

Oda potential consequences dey too.

China na di world biggest manufacturing nation - dem dey produce far more dan dia population dey consume domestically.

Dem already dey run an almost $1tn goods surplus - e mean say dem dey export more goods to di rest of di world pass wetin dem dey import.

And dem dey produce dose goods below di true cost of production due to domestic subsidies and state financial support, like cheap loans, for favoured firms.

Steel na example of dis.

Di risk be say if such products no fit enta US, Chinese firms fit seek to "dump" dem abroad.

While dat fit benefit some consumers, e fit also undercut producers for some kontris wey go threaten jobs and wages.

Di lobby group UK Steel don warn of di danger of excess steel wey dem fit potentially redirect am to UK market.

Di spillover impacts of all-out China-US trade war na say di whole world go feel am, and most economists judgement na say di impact go dey highly negative.

Comments