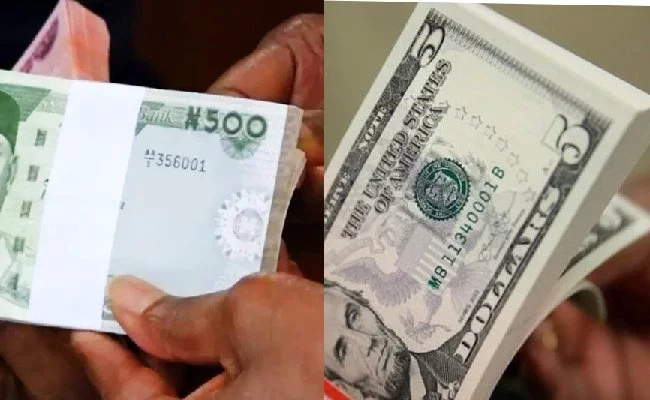

The Naira depreciated at the official market on Monday, trading at ₦1,495.60 to a dollar.

Data from the FMDQ Security Exchange official forex trading platform revealed that the Naira lost ₦20.82.

This represents a 1.4% loss when compared to the previous trading day on Friday, January 31, when the local currency closed trading at ₦1,474.78 to a dollar.

Trading on the Investors and Exporters (I&E) Forex window on Monday recorded a high of ₦1,497.50 and a low of ₦1,470.00.

The Naira has enjoyed relative stability against the dollar since December 2024 due to sustained reforms by the Central Bank of Nigeria (CBN).

The reforms are aimed at ensuring transparency in the foreign exchange (FX) market.

The apex bank's reforms are also boosting the capacity of BDCs that are in the retail end of the FX market.

The apex bank on Tuesday, January 28, in Abuja, approved waivers on the 2025 annual license renewal fee for all existing BDC operators.

The bank also on Monday, February 3 extended the deadline for sales of dollars to BDCs from January 31 until May 30.

Recently, the Naira has appreciated to ₦1,640 per dollar in the parallel market, strengthening from ₦1,655 recorded on Monday, January 29. This development reflects a positive trend amid ongoing exchange rate reforms by the Central Bank of Nigeria (CBN).

Data from the CBN indicates that the Nigerian Foreign Exchange Market (NFEM) rate improved to ₦1,526.3 per dollar from ₦1,533.5 per dollar on Monday, marking a ₦7.2 gain. As a result, the margin between the parallel and official market rates narrowed to ₦113.7 per dollar from ₦121.5 per dollar earlier this week.

The currency's stability in recent months has been attributed to the CBN's policy interventions, including introducing the Electronic Foreign Exchange Matching System (EFEMS) in December and the forthcoming FX code set, which will be launched by the end of January.

Taiwo Oyedele, Chairman of Nigeria's Fiscal Policy and Tax, highlighted the impact of these reforms, stating, "The new FX code introduced by the CBN will enhance transparency, and about $20 million is being taken off the market daily."

CBN Governor Olayemi Cardoso reaffirmed the institution's commitment to stabilising the currency, noting that the naira's depreciation last year has now created investment opportunities.

"We've found ourselves in a situation where the foreign exchange rate has adjusted," Cardoso said during a virtual briefing with the Nigeria Economic Summit Group (NESG).

This presents a chance for investors to take advantage of a currency that is now a lot more competitive."

With ongoing reforms, market analysts anticipate further stability for the naira, which would bolster investor confidence in Nigeria's foreign exchange market.

Comments