DIGITAL money lending firms, popularly known as 'loan apps' have continued posting alleged 'loan defaulters' photos online. But the big question is, what does the law say about this act?

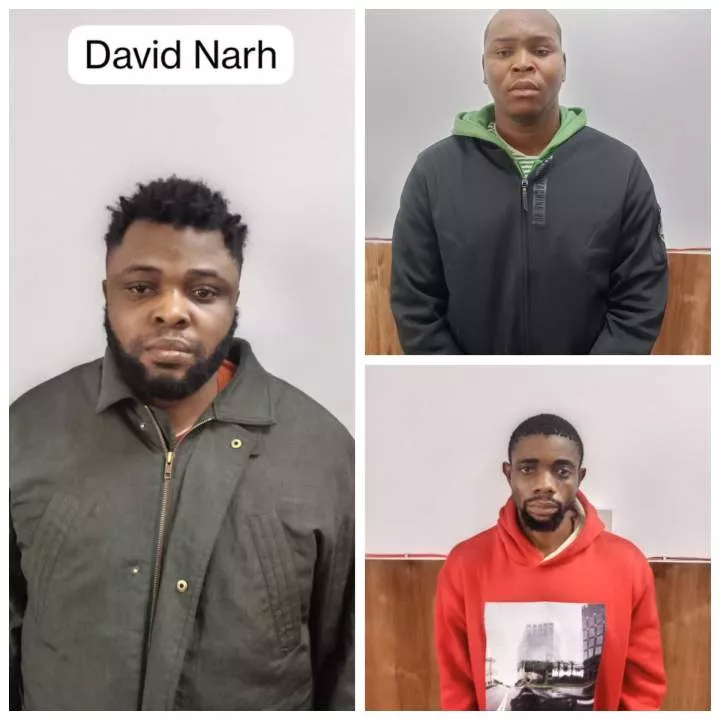

Nigerians woke on January 5, to witness pictures of 87 'loan defaulters' in a video shared online, with the caption "Please settle your loan."

This act, which has sparked outrage across the country, not only raises concerns about privacy violations but also highlights how the loan app's actions may negate Nigeria's laws designed to protect citizens from harassment, cyberbullying, and unauthorised use of personal data.

The ICIR has done extensive reporting on money lending firms and cyberbullying which you can read here and here.

Many loan apps claim to offer quick access to funds but have continuously use unethical ways to retrieve their funds like the recent act of the digital money lenders which has reportedly compiled the images of individuals who allegedly defaulted on their loans and shared them in a video.

The video was then posted online, accompanied by a message urging the defaulters to settle their outstanding debts.

Recall there were attempts by the government to curb the activities of these digital lenders.

In 2023 the Federal Competition and Consumer Protection Commission (FCCPC) delisted up to 37 loan apps for breach of privacy and operating without regulatory approval.

FCCPC had flagged many loan apps for violating the Limited Interim Regulatory/Registration Framework and Guidelines for Digital Lending, 2022, and initiated efforts to shake up the digital money lending space.

Violation of privacy and data protection laws

A Lagos-based lawyer, Abulwasiu Mujeeb, highlighted the position of the law on the action done by the digital money lender. He condemned it as very brutal and unacceptable because it subjects the people involved to depression and intense frustration.

"The behaviour affects mental well-being, and ruins the reputations of the defaulters," he said.

This act raises serious questions about the loan app's adherence to Nigeria's Data Protection Regulation (NDPR), which mandates that personal information should only be processed for specific, legitimate purposes and with the consent of the individual.

He said the Data Protection Act (NDPR), Section 2.4 emphasises that personal data should be processed lawfully and fairly, with the consent of the data subject. The publishing of images without permission directly violates this provision.

Section 3.1 of NDPR on data minimisation also prohibits the use of personal data beyond what is necessary.

"Publicly displaying the defaulters' images online for a non-consensual purpose goes against this principle," he added.

He cited another law that penalises their act as the Cybercrime (Prohibition, Prevention, etc.) Act 2024 as amended, particularly Section 24, which criminalises the use of online platforms to harass or intimidate individuals.

The publishing of these photos and the accompanying message can be seen as an attempt to publicly shame and intimidate the defaulters, creating unnecessary emotional distress.

"Section 24 (1) of the Cybercrime Act makes it an offense to send or transmit messages online that are intended to harass or intimidate someone.

"The loan app's video with defaulters' photos could be perceived as offensive, obscene, and menacing, thus falling under this provision."

Mujeeb noted that the Act also violates constitutional rights, adding that beyond data protection and cybercrime laws, this incident also infringes on the fundamental rights enshrined in the Nigerian Constitution.

He quoted Section 34 (Right to Dignity of the Human Person) which guarantees that no individual should be subjected to inhuman or degrading treatment.

Also, Section 37 (Right to Privacy) guarantees the protection of individuals' private data. Unauthorised publication of personal images is a direct infringement of this right, as it exposes individuals to public shaming without their consent.

Rights of defaulters and legal remedies

When asked if the defaulters have a case even though they are owing, he said what the lenders ought to have done was what defaulters are entitled to now.

He explained that if the loan app couldn't get their money from the defaulters through messages and calls or even through their guarantors, they should have filed a case against them instead of publicly disgracing them.

Even though the way these sharks' approach to contact the defaulters is also another dilemma, he recounted how he was contacted by one of them not long ago in respect of a loan obtained by a friend. "As if we obtained the loan together or I was there when he took the loan," he said.

He said all these should signal a warning to the people patronising the sharks to stand for themselves and work against all odds not to take their loan.

He noted that the defaulters whose pictures were posted online can through the Human Rights Commission to seek redress in court for online harassment, data, and privacy violations.

Last year, the FCCPC warned against utilizing unethical recovery methods, while promising to take a "zero stance" against it.

"... the commission is intensifying enforcement efforts and adopting a zero stance towards any exploitation of consumers or abusive conduct whether in balance calculations, loan default enforcement or recovery process."

The commission however advised consumers to patronise only approved digital money lenders.

Comments