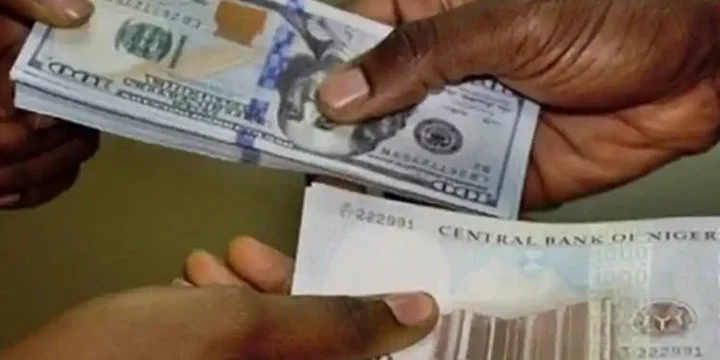

The Nigerian naira rose in the foreign currency (FX) market as demand for the US dollar fell. The local currency rose as the Central Bank of Nigeria (CBN) pumped more than $300 million in foreign exchange sales to banks, increasing liquidity.

At the official exchange window, the naira gained 8 basis points, closing at N1,547.58 per dollar. Market liquidity remained solid, despite ongoing demand pressures on pricing patterns.

Forex dealers said that transactions ranged from N1,545 to N1,551.50. By the end of trade, the Nigerian Foreign Exchange Market (NFEM) had finished at N1,547.9989, a tiny 8-basis-point decrease from the previous session.

In the parallel market, the naira remained steady at N1,660 per dollar amid balanced demand. Meanwhile, global oil prices dropped after U.S. President Donald Trump, inaugurated for a second term, announced plans to declare a national energy emergency. His policy aimed to bolster strategic reserves and prioritize American energy exports.

Brent crude traded at $80.15 per barrel, while West Texas Intermediate (WTI) stood at approximately $76.48. In contrast, gold prices rebounded from earlier losses as investors sought clarity on the Federal Reserve's future policy direction. Gold was valued at around $2,697.60 per ounce.

Comments