African countries continue to struggle with rising debt profiles, resulting in high debt-to-GDP ratios.

These debts are often tied to various infrastructural developments that could benefit the nations, while others result from gross mismanagement by the continent's leaders.

The debt-to-GDP ratio measures the proportion of a nation's debt relative to its Gross Domestic Product (GDP). It serves as a vital indicator of a country's capacity to manage its debt and fulfil financial obligations.

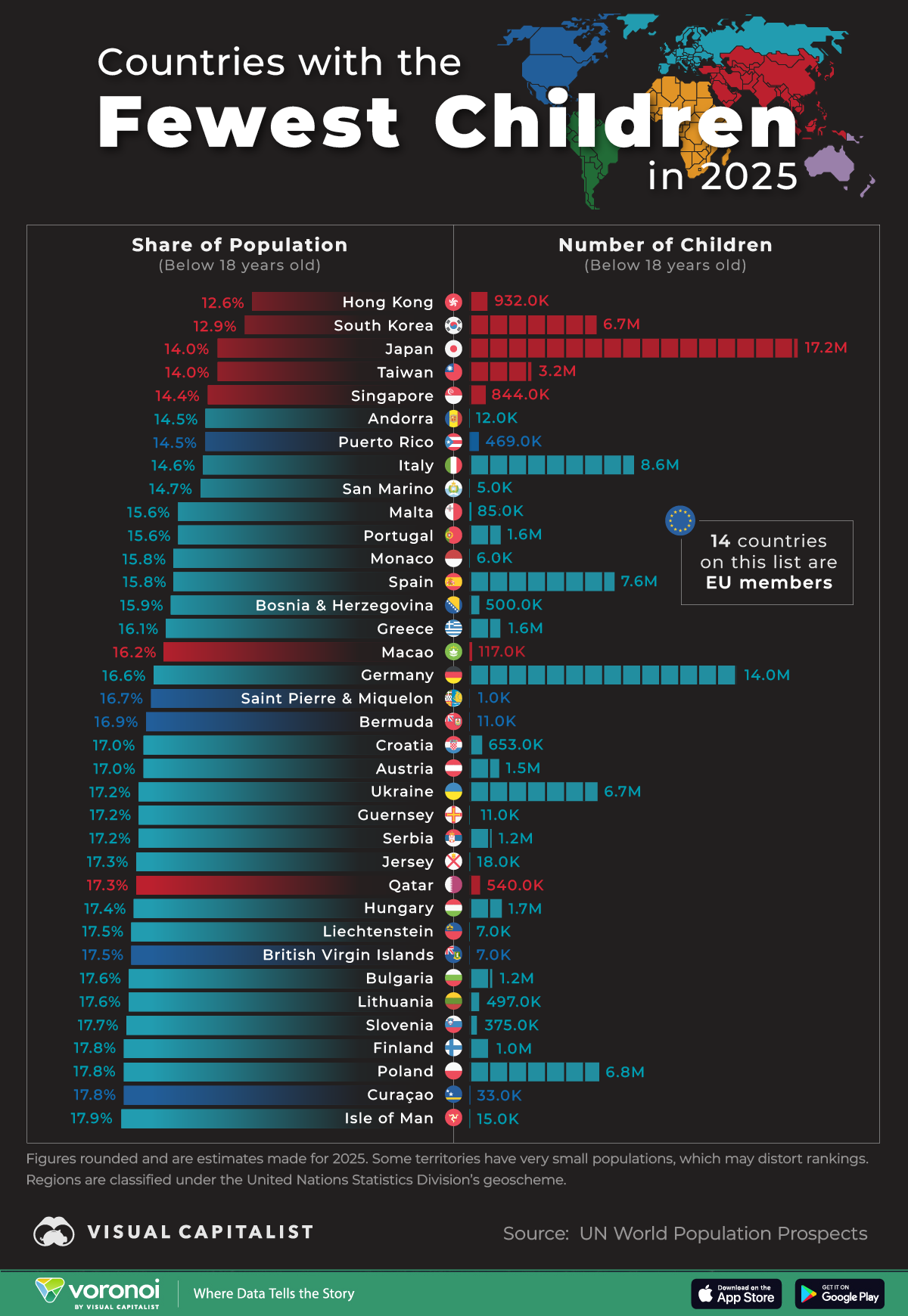

Africa's rapidly expanding population intensifies the demand for essential services such as education, healthcare, and infrastructure.

African countries face higher borrowing costs, economic vulnerabilities, and governance challenges,

However, these critical needs often surpass the pace of economic growth, compelling governments to rely heavily on borrowing to address immediate challenges.

Borrowing serves as an essential mechanism for financing development, but in many African nations, the scale and structure of debt have reached unsustainable levels, sparking concerns about economic stability and growth potential.

Debt in developing nations vs developed nations

The impact of high debt-to-GDP ratios differs between developed and African countries due to key economic, structural, and financial factors.

Developed nations benefit from stable institutions, strong currencies, diverse economies, and favorable borrowing conditions, making high debt levels more manageable.

In contrast, African countries face higher borrowing costs, economic vulnerabilities, and governance challenges, making even moderate debt levels more burdensome.

For comparison, data from the International Monetary Fund (IMF) reveals that the debt-to-GDP ratio in well-developed nations such as the United States (124.1%) and Canada (103.2%) also exceed 100%.

The significant debt-to-GDP ratios of these African nations highlight a concerning picture of the continent's financial health.

According to the IMF, the latest debt-to-GDP ratios for the top 10 African countries are as follows:

| 1 | Sudan | 237.10 |

| 2 | Cape Verde | 107.20 |

| 3 | Mozambique | 96.50 |

| 4 | Rep of Congo | 89.40 |

| 5 | Egypt | 84.50 |

| 6 | Malawi | 82.30 |

| 7 | Mauritius | 80.90 |

| 8 | Senegal | 80.50 |

| 9 | Burundi | 80.40 |

| 10 | Gabon | 79.90 |

Comments