The naira broke below the N2,000 barrier for the first time in five months amid ongoing reforms in Nigeria's currency market.

The naira began the week at N2,225/£1 against the British pound and ended the week at N1,980, showing a price gain of N245/£1 over the week.

The British pound exchanged for N1,980/£1 in the black market on Saturday morning, amid improved market conditions in Nigeria's foreign exchange market.

The country's foreign exchange market has been in a precarious state due to several factors, such as weak oil production, fiscal irresponsibility, low export capacity, increased foreign exchange hoarding, and speculative activity.

However, the Nigerian naira clawed back a significant degree of losses against the British pound this week in the unofficial market, as inflows by the CBN, a successful Eurobond issuance, and a more robust FX trading platform improved confidence in the Nigerian currency.

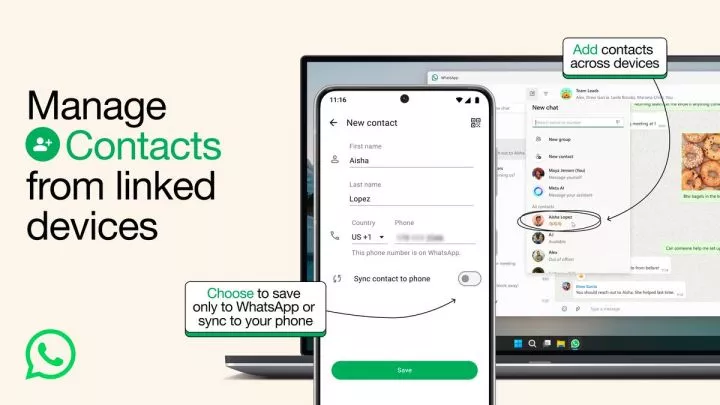

The naira's recent bullish run follows the CBN's directive that all banks involved in the interbank foreign exchange market use the Bloomberg BMatch trading system, which went live on Tuesday, November 26, 2024.

The platform, which aims to improve the FX market in Nigeria, focuses on transparency and operational effectiveness. According to the CBN, the Bloomberg BMatch platform offers an automated trade-matching system to enhance market integrity and promote better price discovery.

Speculators are finding it difficult to adjust to the sudden impact of EFEMS on unofficial forex operations, as evidenced by the naira's sharp increase in the parallel market.

The strength of the naira seems to be translating into more sellers looking to offload and fewer buyers willing to hoard dollars.

The CBN also released comprehensive rules for the Electronic Foreign Exchange Matching System (EFEMS) interbank FX trading system last week to further streamline operations. The centralized pricing mechanism has been crucial in curbing speculative activity and increasing trust in the naira.

A minimum tradable amount of $100,000 has been established by the guidelines, with incremental clip sizes of $50,000 to promote increased efficiency and transparency in the FX market.

EFEMS mandates that all foreign exchange transactions be priced through the system to ensure that daily exchange rates are open and visible to the public.

UK Holds Strong Financial Ties with Nigeria

NBS data revealed that the UK was responsible for almost half (48.9%) of Nigeria's capital investments in H1 2024, totaling $2.93 billion. South Africa and the Netherlands came in second and third, respectively, at 14% and 11%.

The United Kingdom has invested more than $47.5 billion in Nigeria over the last ten years, demonstrating the country's longstanding financial ties. The United Kingdom remains Nigeria's main source of capital imports. In the first quarter of 2024, the UK accounted for 53.5% of all capital imported, with $1.8 billion coming from the country.

British Pound Reaches 3-Week High Against U.S. Dollar

The British pound consolidated at multi-week highs heading into the weekend, following the release of U.S. labor data on Friday.

The British pound has demonstrated resilience, with three consecutive weeks of gains against the euro and two against the U.S. dollar.

British employers' expectations for wage growth have somewhat cooled, according to data released by the Bank of England on Thursday. Although neither release influenced sterling, separate data indicated that activity in the British construction sector increased in November.

The British pound has largely stayed out of the spotlight since Trump's reelection due to high fluctuations in currencies like the euro, Chinese yuan, Mexican peso, and Canadian dollar, whose economies may be subject to tariffs.

The British economy has mostly avoided Trump's wrath, preventing the pound from experiencing significant volatility. Its economy, which is centered on services exempt from tariffs, saw a minor surplus in goods trade with the U.S. in the middle of this year.

The ISM surveys, JOLTS job openings, and ADP employment change were among the mixed U.S. economic data releases that did not change the market's expectations of a rate cut this month, which limited the Greenback's attempts to rise.

The market's anxiety about an impending trade war and geopolitical threats, along with the crucial U.S. Nonfarm Payrolls data release, kept the Greenback stable.

However, despite dovish remarks from BoE Governor Andrew Bailey on Wednesday, the value of the pound sterling recovered. "As inflation eases, I anticipate four rate cuts in the UK next year," Bailey stated.

Comments