Over the past year, there has been a noticeable shift in personal savings behaviours, according to data from the PiggyVest Savings report.

Japa (emigration) is no longer at the top of Nigeria's savings list, according to a recent data from PiggyVest Savings report.

Last year, "Japa" (emigration) was a top savings priority for 21% of Nigerians, ranking third among immediate financial goals. But now, it's taken a backseat to seven other priorities, like saving for personal education, buying a car, and rent or housing, with only 10% of Nigerians currently viewing it as an immediate savings goal.

Per the report, the percentage of Nigerians saving money has decreased from 64% in 2023 to 57%, with 10% of those saving only occasionally. Among those who do save, the primary focus is on building emergency funds, which accounts for nearly 30% of immediate savings goals.

Odun Eweniyi, COO of Piggyvest, links this sharp decline in savings over the past year to several factors. According to her, economic pressures, such as inflation and a significantly higher cost of living, are undoubtedly squeezing disposable incomes and making it harder for people to save.

The savings report, which surveyed over 10,000 Nigerians also shows that many have become financially worse off compared to a year ago, with declines across various metrics, including income levels.

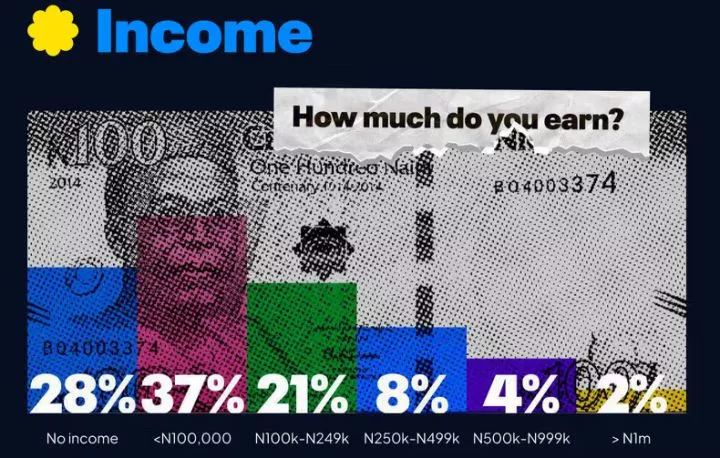

Per the report, 25% of Nigerians have no income, while 37% earn under ₦100,000 monthly, making this the most common income bracket across the country. Only 2% of Nigerians report earning over a million naira each month.

When it comes to income by gender, women in Nigeria are more likely to earn lower wages, with 59% of women earning below ₦250,000 compared to 49% of men.

Comments