Over 90% of new Forex traders lose most of their money due to lack of preparation and unrealistic expectations.Success requires effective risk management, including stop-loss orders, diversification, and a well-developed trading strategy.

Strong self-discipline and a solid understanding of market analysis and trading tools are essential to avoid common pitfalls.

Most inexperienced Forex traders lose over 90% of their money before giving up.

To put it simply, currency trading is the process through which dealers trade FX pairings to profit from the difference between the two currencies.

Even though currency trading has become more popular in Nigeria recently, many people still have terrible experiences with it.

Trading is like entrepreneurship, although it has a few more drawbacks. The high failure rate of businesses can be attributed to the fact that not everyone is cut out to be an entrepreneur.

The following are some of the main reasons trading, self-employment, and entrepreneurship can be challenging:

Insufficient dedication to financial planning

There are numerous ways for forex traders to lose money. Well, being unprepared for the state of the market and having a negative mindset do play a part. It is recommended to treat financial trading like any other kind of business.

Every significant commercial endeavour needs a business strategy. Likewise, a professional trader needs to invest time and resources into developing a trading strategy. At the very least, a trading strategy should include risk/reward ratios, the best times to enter and exit deals, and money management best practices.

It will take time and effort to develop the necessary trading skills and discipline in managing your emotions when initiating deals, but if you want to turn a profit, you need to steer clear of the common mistakes made by inexperienced traders

Poor Risk management

Effective risk management aims to manage, not eliminate, risk in a way compatible with your objectives and risk tolerance. If you set realistic goals that align with your trading style and risk tolerance, you'll be better equipped to trade the Forex market with confidence and discipline.

In Forex trading, stop-loss orders are crucial for effectively managing risk and limiting potential losses.

Diversification is a fundamental component of risk management. By spreading your assets across multiple currency pairings, you can considerably reduce the risk associated with the performance of any one currency combination.

Commissions may also be given to you in the form of rebates, depending on how many new transactions and customers your brokers refer to you.

Forex rebates are sums of money that a broker, such as XM, pays you as a percentage of the commission or spread that you pay on each trade. Over time, this type of return can greatly reduce trade costs.

Many inexperienced traders should start off borrowing very little or nothing. Of course, it all relies on the strategy you use.

Scared of uncertainty and volatility/ Emotional-driven trading mentality

Forex trading requires a person with a strong sense of self-will and a large tolerance for risk. In this market, where leverage makes it possible to borrow money for bigger gains or losses, misuse of such an edge can short you.

If you're uncomfortable with the stock exchange, you should give up on money. Select investments like bonds that are less volatile and risky.

When emotions get the better of an investor, they might make many bad choices, such as selling as soon as there is a fall and waiting for the market to turn around.

Little to no understanding of trading currencies

In an ideal world, currency trading doesn't function like conservative asset classes such as mutual funds, where investors deposit money and then give a financial manager authority to oversee and increase the deposit.

You'll need to research different markets, currency technical and fundamental analysis, and the kinds of trading tools you need to employ.

Not adequately capitalized financially

Before making any acquisitions, especially those involving foreign exchange and other assets, make sure your capital is in order. Ascertain that you have paid off all outstanding debt and maintain a reserve set up for emergencies. To maximize the rewards of investment, it is best to keep money in reserve for a considerable amount of time.

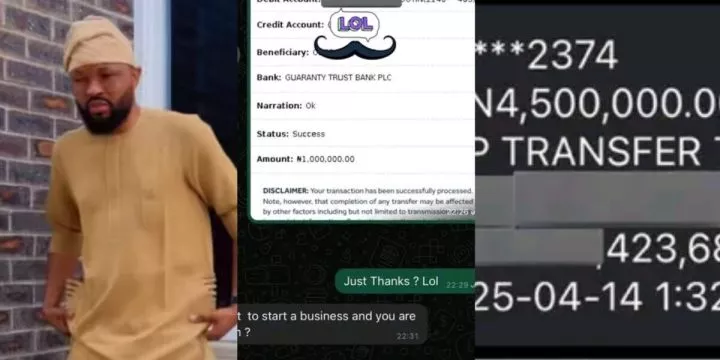

Having unrealistic expectations

Contrary to popular belief, forex trading is not a scheme to make money quickly. It's not a sprint; For success, the necessary trading strategies must be repeatedly learned. Swinging for the fences or attempting to manipulate the market to produce exceptional profits typically results in trading with more capital at risk than the possible benefits.

Contrary to popular belief, Forex trading is not a scheme to make money quickly. It's not a sprint; for success, the necessary trading strategies must be repeatedly learned. Swinging for the fences or attempting to manipulate the market to produce exceptional profits typically results in trading with more capital at risk than the possible benefits.

Bottom line: Even though most traders lose money, it is not a guarantee that you will too. Put your attention on strengthening risk management, creating a profitable trading strategy, and fixing any weak points.

Comments