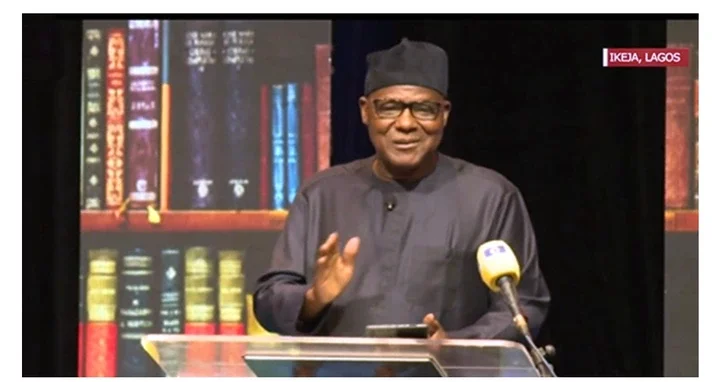

According to Channels TV, Former Speaker of the House of Representatives, Yakubu Dogara, suggested that stabilizing the faltering naira could be achieved by unlocking "idle" foreign exchange stored in private vaults.

Speaking on Wednesday at The Platform Nigeria, an event organized by Covenant Nation to commemorate Democracy Day 2024, Dogara stressed the need for prompt action from monetary authorities.

The event, themed 'Democracy and the Free Market Economy,' featured notable attendees including Anambra State Governor Chukwuma Soludo, former Minister of Works Babatunde Fashola, and Bishop Matthew Hassan-Kukah of the Catholic Diocese of Sokoto.

Dogara, who served as Speaker from 2015 to 2019, expressed concern about Nigerians' excessive demand for US Dollars (USD), which he argued has led to the continuous decline in the naira's value.

He noted, "All shady and authentic deals are closed in USD," highlighting how the US currency has become the favored medium for transactions in Nigeria. He emphasized that unless this demand for USD is reduced, the naira will keep depreciating.

As the naira's value dropped from about N800/$1 in May 2023 to approximately N1,500/$1 currently, Dogara pointed out that Nigerians have lost faith in the naira as a reliable store of value. He urged the government to take swift action to restore confidence in the national currency.

Dogara proposed a solution, stating, "The USD is not going away anytime soon. The challenge before the government is how to unlock and make the USD locked up in private vaults in Nigeria begin to chase the naira.

That to me, is the commonsensical solution. I believe we have enough dollars in this country that we can unlock to make our economy work and crash the FX rate." He believes that mobilizing these dormant dollars could strengthen Nigeria's economy and significantly lower the exchange rate.

He concluded that the government should immediately focus on strategies to release the foreign currency stored in private holdings into the economy.

Comments