What would happen if this year crypto adoption tripled - say, reaching 15% globally?

Chaos would ensue. Latency issues, enormous backlogs of unconfirmed transactions, skyrocketing gas fees, and stolen funds would become rampant. Moreover, the surge in hacking due to underdeveloped bridges and security protocols would go largely unpunished, as adoption outpaces regulatory frameworks. This noise would likely tarnish blockchain's reputation, causing users to off-board as quickly as they onboarded.

This isn't a fire drill in a concrete building. In 2017, when Bitcoin's price increased twentyfold, the number of blockchain users doubled within a year, causing similar disruptions, albeit on a smaller scale.

New technologies often incubate for decades before achieving mass adoption. However, once the floodgates open, there's no turning back.

For example, contactless payment technology was introduced in the early 2000s and saw steady but limited adoption initially. The COVID-19 pandemic significantly accelerated global adoption of contactless payments. Health concerns and the need for social distancing led to a surge in contactless transactions. According to Mastercard, in Q1 2020, contactless transactions grew 40% worldwide. Now, in Europe, over 75% of all card transactions are contactless. This rapid shift demonstrates how quickly change can occur, and the same can happen with crypto in an instant.

Restrictive capital controls, hyperinflation, trade restrictions, and political instability - all potentially brought on by escalating global conflicts, another pandemic, or an environmental disaster - the list of potential catalysts for a mass-adoption event goes on.

It's 2024, and while there's no iceberg in sight, it's a foggy, dark night in the North Atlantic.

It's ironic, really. After all, at Coinspaid, we pride ourselves as crypto missionaries, dedicated to increasing crypto adoption. Yet, this novel, hyper-fast, cheap, secure, and decentralised way to move money requires a controlled adoption curve.

In short, the industry needs more time to test and deploy effective scaling solutions, fix interoperability issues, and determine the importance of a decentralised environment for the future of finance. Let's now take a look at the long version.

The Chassis Needs a Tweak

Bitcoin's whitepaper came out in 2008 - but almost instantly, despite its novelty, developers started working on a replacement system. But, why?

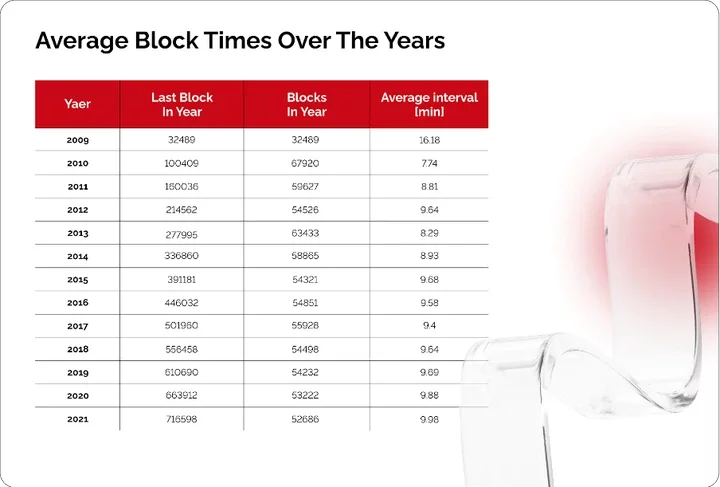

Bitcoin uses a proof-of-work consensus mechanism to record transactions. The biggest issue, in my view, is the limited speed of the chain. Nakomoto made sure to employ a mechanism that would automatically adjust the difficulty of mining, to make sure that a new block was mined as close to 10 minutes as possible. In theory, it's a good idea - it allows enough time for a newly mined block to propagate through the network, which is good for maintaining transaction validity, but not long enough so that it'll disincentive use of the network.

However, when we bear in mind that only around 2-3,000 transactions can be processed per block (initially capped to prevent denial-of-service attacks), things start to fall apart. Compare this with the approximately 1,375,000 transactions that are made in the traditional financial system over the same period, and it's clear that Bitcoin can not, and was never designed to, service the entire population.

Such glaring scalability issues combined with rocketing adoption in the crypto world have led to somewhat of a development panic when it comes to new consensus mechanisms.

We've experienced a new proposal for an overhaul of the blockchain pretty much every year since it began.

2012: Peercoin introduces PoS.

2014: BitShares launches DPoS; Counterparty introduces PoB; Burstcoin develops PoC.

2015: IOTA's DAG-based consensus and Hyperledger Fabric's PBFT.

2016: HoneyBadger BFT and Hyperledger Sawtooth's PoET.

2017: Cardano's Ouroboros PoS and VeChain's PoA.

2019: Chia's PoST.

2020: Solana's PoH with PoS and Avalanche's consensus protocol.

2021: Ethereum 2.0's Casper PoS.

While many developers would argue that there's no 'one-size fits all' solution, the landscape looks a lot like we can't agree on a blueprint for the 'perfect' blockchain layer 1. I believe, in the perfect system, we'd likely have a group of blockchains that, between them, cover all the requirements of a Web3 financial infrastructure. But, that's just my opinion, and I shall be disagreed with, just like I disagree with others.

Quod erat demonstrandum.

Interoperability Issues

Let's assume for a moment that my quarrel has subsided with my developer friends, and we've agreed on a number of 'perfect chains', that between them, are able to service the entire population.

Well, there's a catch, and that's the issue of interoperability, which refers to the ability of blockchains to interact with one another.

It's important that the consensus mechanisms of two interacting blockchains can reliably validate and agree on cross-chain transactions. For instance, a transaction validated on a PoW chain like Bitcoin might need to be recognized and accepted by a PoS chain like Ethereum 2.0. This can create issues.

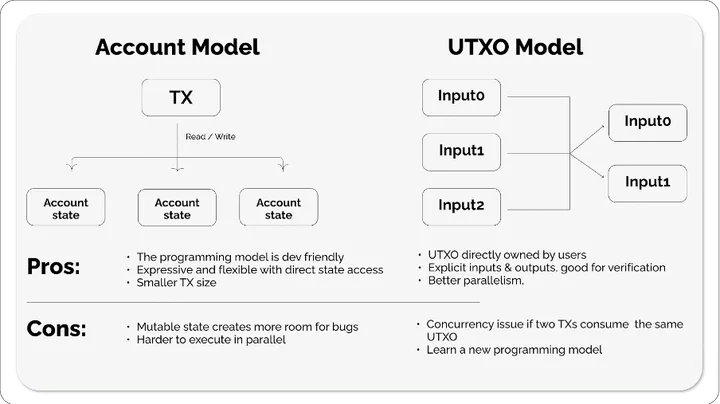

For example, Bitcoin mitigates double-spending by using the UTXO model, where each transaction consumes and creates unspent transaction outputs (UTXOs). Ethereum, on the other hand, uses an account-based model and maintains a state root, which is a cryptographic hash representing the state of all accounts. This state is updated with each block to reflect transactions and other state changes.

These systems are very difficult to get to interact with one another. In other words, how can you transfer your assets across chains without relying on someone wanting to move their assets in the opposite direction?

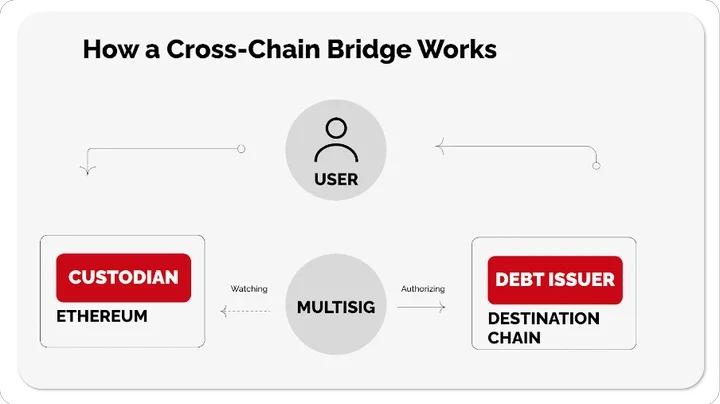

One of the most popular ways that we approach this is via cross-chain bridges - protocols that more often than not operate by locking up coins on one chain, and minting new ones on another.

This initially seems like a viable solution until we recognize that these bridges, which hold substantial amounts of locked funds, become prime targets for hackers - a classic 'central point of failure.' Here's an overview of the major cross-chain bridge hacks that have occurred over the past few years.

2019: Binance Chain to Ethereum Bridge - $7.5 million

2021: Poly Network - $610 million

2021: THORChain - $7.6 million

2021: ChainSwap - $8 million (total across two incidents)

2022: Wormhole Bridge - $325 million

2022: Ronin Bridge - $624 million

2022: Qubit Finance - $80 million

2022: Harmony Horizon Bridge - $100 million

2022: Nomad Bridge - $190 million

2023: Multichain (Anyswap) - $130 million

In response to this, developers have tried to explore alternative solutions.

Among the better ones, there's Cosmos' IBC Protocol that works on a client-server model, Hash Time-Locked Contracts, which make up the technology behind many atomic swap integrations, Chainlink's Cross-Chain Interoperability Protocol (CCIP) that uses smart contracts operating on multiple chains to facilitate interactions, and there's also the Interledger Protocol (ILP) that acts as a kind of federation to facilitate cross-train transactions.

But again, the list goes on, and while many would argue that 'there's no one-size fits all solution', it just seems like we can't decide on a solution to interoperability.

Decentralisation - Need or Want?

I say the following as a long-term student of Russian history, and as someone that wrote about post-revolutionary literature for my Master's thesis.

It's easy to get swept up in needless revolution just for the fun of it.

In the 1920's, public interest in Communism reached an all time high - it was seen as the 'natural' system of governance. This is very interesting for me as it's as 'centralised' as a governance model can be.

Now, a century later, we're fascinated with the idea of 'decentralisation', seemingly the banner of the blockchain.

After all, Nakomoto encoded the following message into Bitcoin's Genesis block, hinting towards the malignancy of 'centralisation':

"The Times 03/Jan/2009 Chancellor on brink of second bailout for banks"

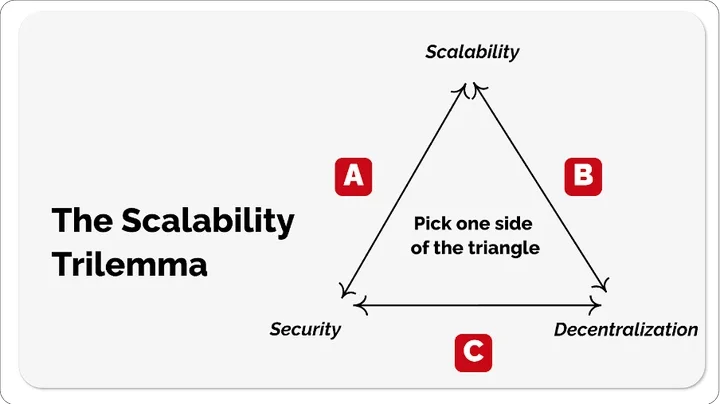

Ever since then, Bitcoin and cryptocurrencies have been seen as a symbol of decentralisation. This bothers me, as when approached with the scalability trilemma, projects will tend to sacrifice decentralisation in favour of improved security and scalability. It is always the weakest link.

Here's some data to consider. As of late 2023, DEXs (decentralised exchanges) only account for less than 10% of the trading volume.

Also, as much as we like to think so, non-custodial wallets aren't all that popular, and still, custodial wallets are favoured for their practicality and simplicity.

Arguments for more decentralisation centre around ideas such as transparency, trust, security, anonymity, censorship resistance and empowerment.

But, what happens with taxes, public services infrastructure in a fully decentralised system? If you were to establish a decentralised autonomous organisation (DAO) of sorts, how do you solve the free-rider problem, or issues such as voter turnout?

As an example, recent data suggests that voter turnout in DAOs typically hovers around 10-15% of the total token holders. For instance, reports from various DAOs indicate turnout rates often fall below 20%, even for significant proposals.

With such low turnout, cartels appear, and centralisation returns.

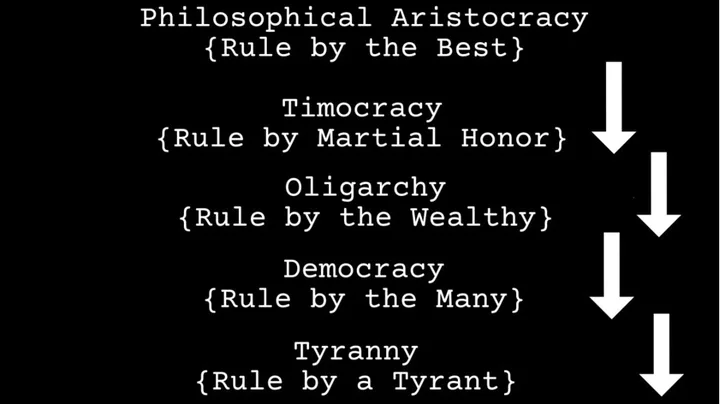

This is an age-old political pendulum. A good point of reference would be book VIII of Plato's Republic, where the cycle of government is proposed. He explains how each form of government emerges from the previous one due to inherent flaws and societal changes. Specifically, how from a decentralised form of government will always appear a centralised one, until there is a revolution, and on-goes the cycle.

The typical crypto user today isn't someone who contributes to a Bitcoin mining pool, funnels funds through mixers, or trades exclusively on decentralised exchanges like 1inch. Instead, they are more likely to be paid in stablecoins, backed by short-term U.S. Treasury bonds to maintain their value, and engage in trading on centralised exchanges such as ByBit or Binance, adhering to full KYC (Know Your Customer) requirements.

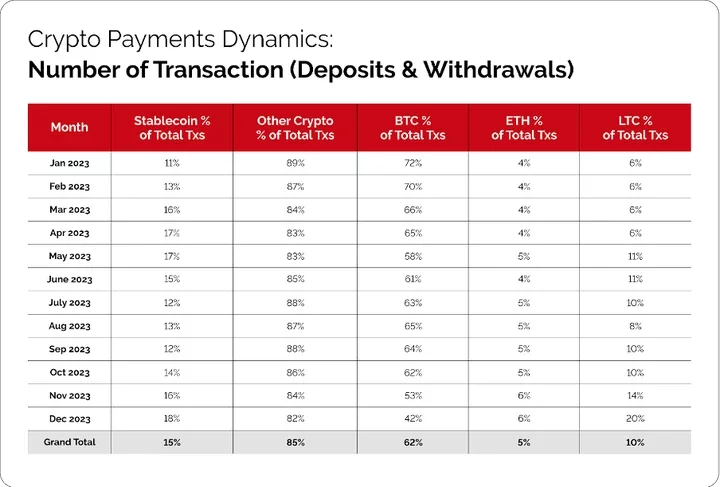

Our data from CryptoProcessing.com supports this trend, showing a decline in Bitcoin transactions and a notable increase in the use of stablecoins.

So, perhaps the future of Web3 is not meant to be a decentralised one.

But, maybe it is - novel concepts that aim to put the decentralisation 'back into crypto' are appearing at the same pace of new consensus mechanisms and interoperability solutions. Concepts such as disintermediation, distributed authority and access democratisation are all fascinating concepts, one or more of which might just enable a hybrid system that succeeds in inspiring greater consumer appetite for DeFi - only time will tell.

For now, we still can't decide how important decentralisation is to the future of web3, and we need to be certain if we're going to onboard the world.

Final thoughts

"Indecision and delays are the parents of failure", as former British Prime Minister George Canning once remarked.

If he were to witness British politics nearly two centuries later, he would see his words come to life with Brexit. A narrow 1.9% voting difference led to what many consider a 'failure,' with around 70% of Britons believing it has harmed the economy. The lack of social and political cohesion has been identified as a key factor in this outcome. Had there been time to develop a clear and unified vision with stronger political consensus, Brexit might have been deemed a success.

While references to Plato, Canning, and Brexit might seem tangential in an article about blockchain, they underscore a crucial point: we can't rush into things. Blockchain has the potential to revolutionise the global financial system from top to bottom, side to side. From Central Bank Digital Currencies (CBDCs) at the government level to innovations like EIP 4337's account abstraction, which could provide unparalleled access to underbanked populations, the ecosystem is indeed exciting.

As we've explored today, blockchain technologies are evolving at an astonishing pace. Traditional 10-minute block times are being replaced by faster proof-of-stake consensus mechanisms. In response to significant cross-chain bridge hacks causing multi-million dollar losses, protocols like Cosmos' IBC are gaining traction. Additionally, as we grapple with the complexities of stablecoin collateralization, there is a noticeable shift towards more stable, centralised blockchain models. This suggests a growing realisation that decentralisation may not be an absolute necessity.

However, I firmly believe that we are not yet ready for mass adoption.

We must first develop the necessary infrastructure to handle increased usage, secure robust interoperability solutions, and ensure that decentralisation remains integral to the blockchain trilemma. Most importantly, we need to learn how to achieve consensus as a community, not just within the blockchain itself.

Comments