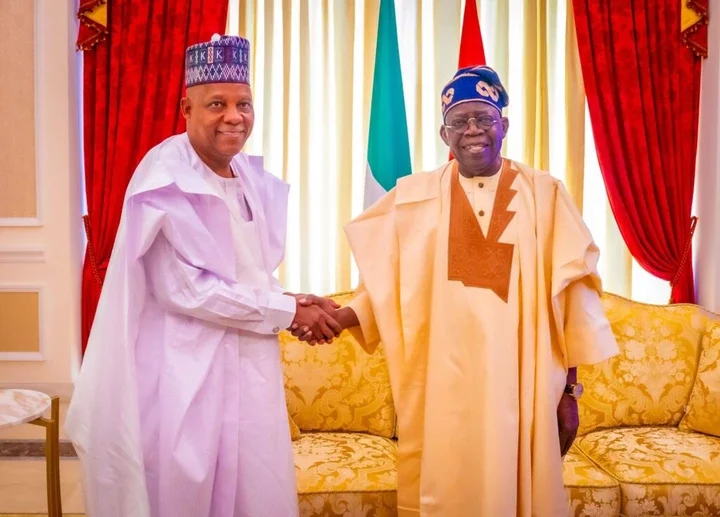

Vice President Kashim Shettima has stated that the tax reforms implemented by President Bola Tinubu's administration are aimed at enhancing the overall well-being of Nigerians.

He disclosed this at the final retreat of the Presidential Fiscal Policy and Tax Reforms Committee, held at Transcorp Hilton in Abuja, according to a statement by his spokesperson, Stanley Nkwocha, on Saturday.

"We are not here to frustrate any sector of our economy but to create an administrative system that ensures the benefits of a thriving tax system for all our citizens," Shettima said.

The Vice President, represented by his Special Adviser on General Duties, Dr. Aliyu Moddibo Umar, elucidated the core objectives of the administration's tax reforms. He highlighted that the evolving dynamics of the national fiscal landscape necessitated a strategic reassessment by the Tinubu administration.

"Our aim remains the revitalisation of revenue generation in Nigeria while sustaining an investment-friendly and globally competitive business environment," he noted.

Furthermore, the Vice President expressed strong confidence in the Presidential Fiscal Policy and Tax Reforms Committee's ability to execute its mandate, emphasizing the critical shift from planning to implementation.

He affirmed that both federal and state governments are ready to facilitate the effective execution of the committee's reforms and committed to providing the institutional support needed to integrate these proposals with the administration's broader economic strategy.

What you need to know

Several tax reforms have been implemented under President Bola Tinubu's administration, aimed at increasing government revenue.

The administration seeks to boost the tax-to-GDP ratio from the current 10.86% to 18%, reduce multiple taxation and tax evasion, and promote a healthy tax culture.

Nairametrics reported in January 2024 that the Federal Inland Revenue Service (FIRS) plans to increase its tax revenue collection by 57% to N19.4 trillion.

Recently, the Central Bank of Nigeria.(CBN) required financial institutions to deduct a 0.5% cyber security levy from electronic transactions, as per the 2024 Cyber Crime Amendment Act, to support national cyber security efforts led by the National Security Adviser (NSA).

Despite delays, the Federal Government intends to introduce excise duties in the telecoms and gambling sectors and increase the VAT rate next year.

These tax reforms have elicited varied reactions. Some argue they will further strain citizens already facing economic challenges, while others believe the reforms are essential to fund government projects for the public good.

The International Monetary Fund (IMF) recently endorsed President Bola Ahmed Tinubu's administration for its economic reforms, particularly praising efforts in revenue mobilization and governance enhancement.

Comments