With service delivery in the financial services sector being gradually taken over by Artificial Intelligence (AI), Nigerians are at risk of data abuse from providers of financial services, LEADERSHIP can now reveal.

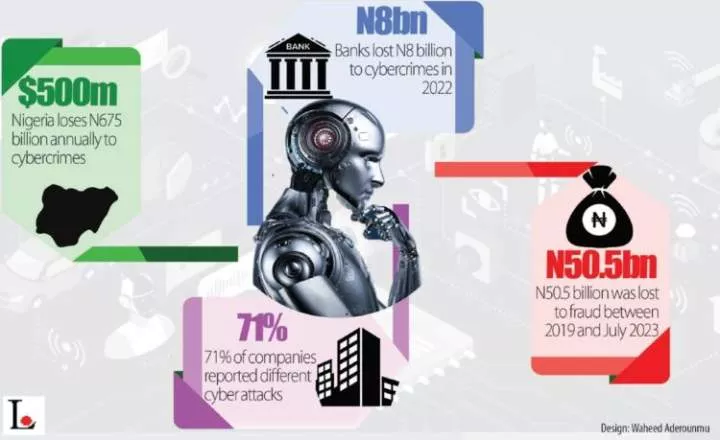

This is as Nigeria is losing $500 million to cybercrimes, translating to N675 billion annually using the N1,350/$ conversion rate that the nation's currency traded at the weekend.

Data from the Nigerian Communications Commission (NCC) shows the country loses the aforementioned annually to various forms of cybercrimes, with the banks losing N8 billion to cybercrimes in 2022.

While NCC disclosed that 71 percent of companies reported one form of cyber-attack or another, the Nigeria Interbank Bank Settlement System (NIBSS) disclosed that the financial industry lost N50.5 billion to fraud between 2019 and July 2023.

Artificial Intelligence (AI) is a simulation of human intelligence into a machine format such that the machine can do routine tasks faster.

As much as AI is good for promotion of banking, insurance and pension businesses, experts have pointed out the challenge in data protection and privacy.

There are concerns that private data submitted to financial sector providers, which ought to be secret, could be exposed through AI, thereby serving as a breeding ground for cybercriminals to launch attacks on unsuspecting customers of banks and other financial services providers.

To this end, Nigerians have been warned to beware of AI-induced software they download on their phones as most of them spy on private information that could be hacked by hackers to perpetrate their evil acts.

Financial firms have reported significant direct losses, totaling almost $12 billion since 2004 and $2.5 billion since 2020, the International Monetary Fund (IMF) has disclosed.

In its April 2024 Global Financial Stability Report released recently, IMF stated that attacks on financial firms account for nearly one-fifth of the total, of which banks are the most exposed.

Similarly, informational technology (IT) professionals are concerned about the threat landscape associated with Artificial Intelligence (AI), and have revealed that attackers are now using sophisticated linguistic techniques, such as longer sentences, more punctuations and increased text volume, to carry out attacks, particularly in the financial industry.

As they anticipate more threat actors utilising AI to enlarge every facet of their offensive toolbox, IT experts claim that generative AI enables attackers to quickly and efficiently create complex and targeted attacks.

The latest report from Computer Crime Research Centre (CCRC) has projected that the cost of cybercrime will rise to $12 trillion by 2024 due to AI technology, saying: "As we move forward in 2024 and 2025, in the market will see attackers adopting AI to carry out their attacks. AI will be adopted to deliver more cost-efficient, rapid development of new malware and ransomware variants.

"Deepfake technologies will take phishing and impersonation attacks to a new level. Businesses will embrace AI but will be threatened by its use in novel cyber-attacks. There is also a risk that the dynamic character of AI-driven attacks could make static defence mechanisms ineffective.

"Vertical segments covering manufacturing, retail, professional services, financial, and utilities will be the most vulnerable. This is partly driven by vulnerabilities across the legacy nature of their network, technology maturity, and elevated risk impact levels to the business as a result of cyber-attacks," the report revealed.

Corroborating the findings of the research, retired director, Nigeria Deposit Insurance Corporation (NDIC), Dr. Jacob Afolabi, observed that there had been a plethora of significant incidents concerning cyber threats in 2023, all of which have a wide range of effects on governmental or organisational entities.

Afolabi explained that Al technologies often collect and analyse large amounts of data, raising issues related to data privacy and security.

"As Al technologies become increasingly sophisticated, the security risks associated with their use and the potential for misuse also increases. Hackers and malicious actors can harness the power of Al to develop more advanced cyber-attacks, bypass security measures, and exploit vulnerabilities in systems," he asserted.

To diminish privacy risks, Afolabi advocated strict data protection regulations and safe data handling practices.

While over-reliance on Al systems may lead to a loss of creativity, critical thinking skills, and human intuition, the retired director stressed the need to strike a balance between Al-assisted decision-making and human input, which is vital to preserving human cognitive abilities.

"Al-driven automation has the potential to lead to job losses across various industries, particularly for low-skilled workers. To mitigate the risk, the workforce must adapt and acquire new skills to remain relevant in the changing landscape. This is especially true for lower-skilled workers in the current labour force," he added.

In the same vein, the government affairs director, Microsoft Africa, Akua Gyekye, stated that when it comes to using AI safely, one of the most effective ways to accelerate progress is to build on existing governmental frameworks.

Several African countries, he stressed, had already begun to formulate their own legal and policy frameworks and are helping to lead discussions around AI policy and strategy development on a regional, continental, and global scale, offering valuable insights for other countries looking to do the same, adding that, while at different stages of implementation, they all are looking to find balance between the need to create guardrails for the new technology and at the same time wanting to help a nascent industry grow, innovate, and adopt these new and emerging technologies.

She stated that the African Union (AU) continues to convene experts from across the continent and this year published a policy draft containing a comprehensive continental strategy for AI regulations for African countries.

The head of corporate planning, strategy and risk management at the Nigerian Communications Commission (NCC), Kelechi Nwankwo, explained that the fast-disruptive world of the telecoms industry had witnessed the convergence of diverse technological advancements with the potential to reshape the future.

Expressing similar concern, the managing director/CEO, Guinea Insurance Plc, Ademola Abidogun, said that as much as artificial intelligence is good for the promotion of insurance and pension businesses, the challenge lies in data protection.

"AI helps profile customers and assists in carving out a product that suits the needs of each customer, relying on their data to know what each customer wants at any point in time.

"Yet, as good as AI is, there are the issues of data protection and privacy. This is critical so that sensitive information about a customer is not abused by data harvesters, thereby tramping on their privacy. There should be regulation on data that can be harvested for use, and on some sensitive information, there should be consent before that information can be used. Stakeholders should come together to address this, especially in the era of cybercrimes and attacks," he stated.

The IMF had earlier said cyber events constitute a major operational risk that might jeopardise the operational stability of financial institutions and negatively impact macrofinancial stability as a whole.

To strengthen resilience in the financial sector, the IMF suggested that central banks and authorities must create a sufficient national cyber security strategy and implement efficient regulation and supervisory measures, which should include: regular evaluation of the state of cyber security and detection of possible systemic vulnerabilities resulting from concentrations and interconnections, including those arising from third-party service providers; improved cyber-related governance to lower cyber risk and supports the idea of promoting cyber 'maturity' among financial sector companies, including board-level access to cyber security knowledge, among others.

Similarly, the chairman of the Committee of Chief Information Security Officers of Nigerian Financial Institutions (CCISONFI), Mr. Festus Amede, stated the importance of implementing robust security measures to protect sensitive financial data in the face of emerging threats.

Phillips Consulting Limited (PCL), in a report, noted that the surge in big data, driven by customers' digital interactions and the utilisation of structured and unstructured data, along with the rapid expansion of cloud technology and robust computational resources, has accelerated this transformative change, enabling organisations to embrace AI with unprecedented readiness.

Comments