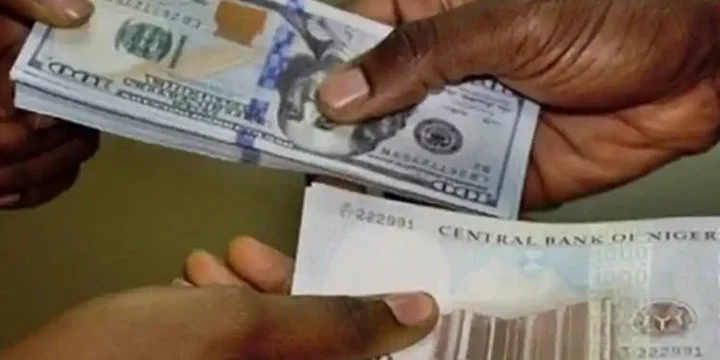

The Naira exhibited signs of resilience against the US dollar, appreciating by N125 to reach N1,275/$1 during the weekend, marking a notable 9.8% increase from its Friday closing rate of N1,400 to a dollar.

The Senate, through its Committee on Finance, emphasized the necessity for collaborative efforts from all stakeholders to uphold and stabilize the Naira amidst ongoing fluctuations.

Currency traders at the bustling Wuse Zone 4 market, interviewed by our correspondent on Sunday, attributed the exchange rate fluctuations to market uncertainty. They stressed the need for the government to either bolster or devalue the currency for market stability.

Malam Yahu Ibrahim, a trader, voiced concerns over the Naira's instability, highlighting the risks traders face daily due to the currency's erratic swings. He urged decisive action from the government to either strengthen or devalue the Naira to alleviate market uncertainties, citing adverse effects on businesses.

Abubakar Taura, another trader, echoed apprehension regarding potential drastic measures from the Central Bank of Nigeria (CBN) to stabilize the Naira, making it challenging to predict Monday's rates.

The Naira's recent resurgence aligns with plans by the Association of Bureaux De Change Operators of Nigeria (ABCON) to unify the retail end of the forex market, aiming to curb volatility and enhance regulatory compliance.

ABCON President, Aminu Gwadabe, outlined initiatives such as geo-mapping and automated verification exercises to facilitate seamless transactions and improve market transparency.

Prior to this marginal gain, the Naira had depreciated by 26.2% within two weeks, compared to its April 12, 2023 rate of N1,125 per dollar on the parallel market.

Last Monday, the Central Bank of Nigeria allocated $15.83 million to 1,583 BDC operators to bolster liquidity in the unofficial market.

In parallel, data from FMDQ Securities Exchange indicated a continued downward trend of the Naira against the US dollar.

Comments