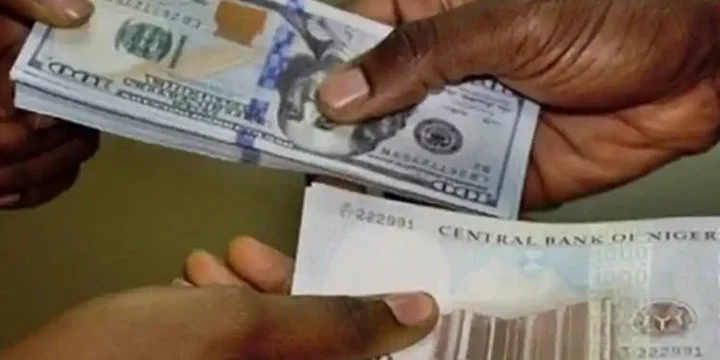

The Nigerian naira experienced a significant surge in the parallel foreign exchange (FX) market, hitting N1,120 to the dollar on Monday, indicating a 9.67 percent increase compared to N1,240/$ recorded on April 3.

Reports from TheCable indicate that Bureau de Change (BDC) operators in Lagos quoted the purchase price of the dollar at N1,100 and the selling price at N1,120, yielding a profit margin of N20 per dollar.

This positive momentum extended to the official trading window, where the naira strengthened by 1.63 percent to N1,230.61/$, up from N1,251.05/$ on April 5.

Transactions on the FMDQ Exchange platform, which oversees the Nigerian Autonomous Foreign Exchange Market (NAFEM), witnessed a significant trading volume of $125.55 million.

The disparity between the parallel market and official rates narrowed to N110.61 by the close of trading, reflecting positive market sentiment.

This favorable trend is in line with Goldman Sachs' prediction from March 10, forecasting the naira's appreciation to N1,200/$ within a year. The financial giant cited Nigeria's progress in addressing currency challenges, suggesting an undervaluation of the naira and the potential for further appreciation.

Despite ongoing depreciation concerns, interventions by the Central Bank of Nigeria (CBN) in the FX market have yielded notable results. The CBN adjusted its sales to BDCs from $20,000 at N1,301/$ in February to $10,000 at N1,251/$ in March.

On Monday, the CBN further reduced the rate to N1,101/$ while reaffirming its support for BDCs with continued $10,000 sales, demonstrating proactive measures aimed at stabilizing the naira's value in the FX market.

Comments