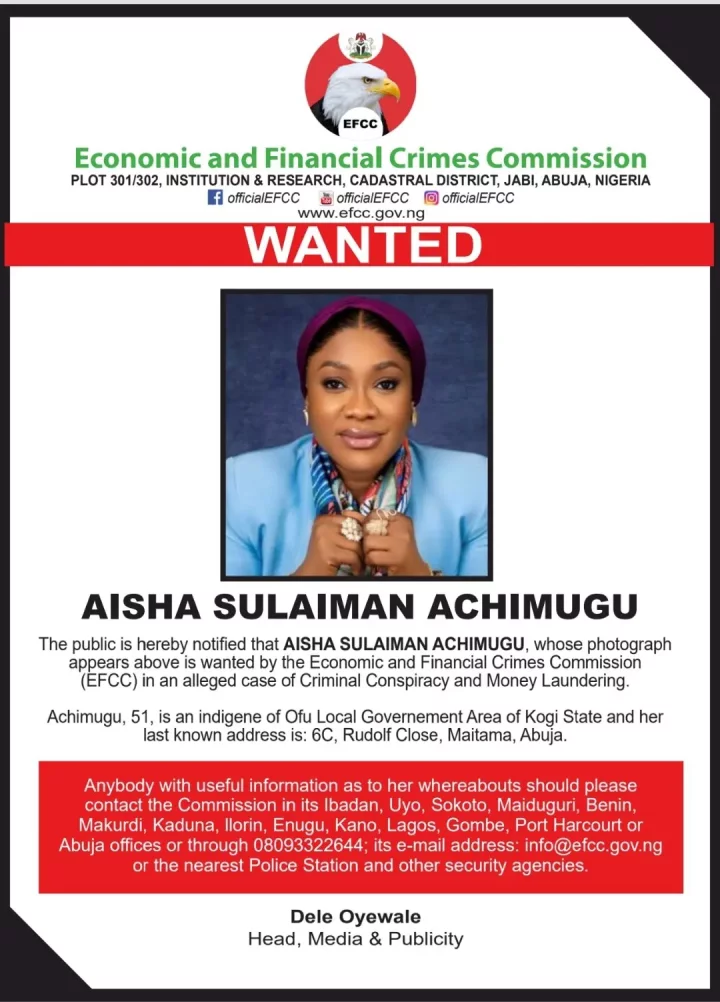

Identity fraud is a growing problem across Africa, costing businesses millions yearly. The situation has intensified with the increasing shift of financial transactions and commerce to online platforms. Hence, ensuring the verification of identities is paramount in reducing deception and criminal activities.

Smile ID, a leading identity verification startup in West Africa, published its 2024 Digital Identity Fraud in Africa Report, offering insights into fraudulent verification attempts on the continent. Since its establishment in 2017, the company has conducted over 100 million checks in Africa.

According to the report, in the last two years, an overwhelming number of fraud attacks were directed at National ID cards, which accounted for 80% of all document fraud attacks.

Central and East Africa experienced the highest identity fraud rates, reaching peaks of 29% and 30%, respectively. Southern Africa reached a peak of 23%, while West Africa recorded the lowest fraud rate, peaking at 20%.

South Africa's national ID topped the list with the highest fraud attempts at 38%. Tanzania secured the second spot with 32%, followed by Kenya at 26%, and Uganda ranked fourth with 25%.

The report stressed that, while regulatory compliance is fundamental, businesses must surpass regulatory requirements to safeguard the integrity of their products.

| 1 | Green Book (National ID) | South Africa | 34% |

| 2 | National ID | Tanzania, United Republic of | 32% |

| 3 | National ID | Kenya | 26% |

| 4 | National ID | Uganda | 25% |

| 5 | Passport | Democratic Republic of Congo | 23% |

| 6 | SSNIT (National Insurance) | Ghana | 20% |

| 7 | Passport | Malawi | 19% |

| 8 | Passport | Ghana | 19% |

| 9 | National ID | Nigeria | 18% |

| 10 | Ghana card (National ID) | Ghana | 16% |

Comments