The value of any currency is never constant, rather it is based on a number of factors such as interest rates, economic growth, inflation and the influence of another currency on it.

A high inflation rate in a country will lead to a currency devaluation and therefore decrease its value compared to other currencies.

Here's a list of 3 weakest currency countries in Africa.

1. Sao Tome and Dobra Principe

(1 USD equivalent to STD 21,050)

Soa Tome and Principe Dobra is Africa's weakest currency, with over US$20,000 in one dollar.

Sao Tome is a small country in central Africa whose primary source of revenue is exports of cocoa, coffee and cocoa, but this is not sufficient to promote the country's local economy.

First introduced in 1977, the currency has depreciated over the years.

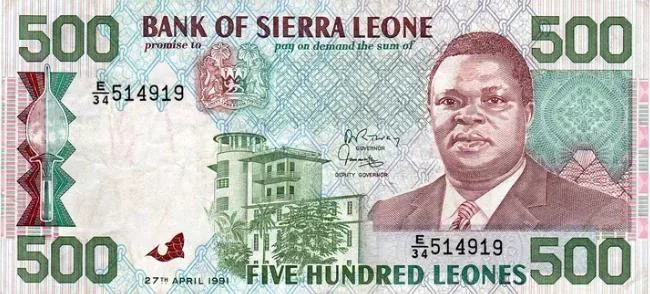

2. Seirra Leone (SLL)

1 $ equals 10,250 SLL

The serria Leone is the official Serria leone currency, it is divided into 100 cents, which are no longer in use because the currency's value is low.

Sierra Leone (SLL) is suffering high inflation as a consequence of civil war, economic battles, the pandemic of Ebola and Covid 19. The currency of the country is weak because of the high level of inflation, corruption and increasing poverty in the country

3. French Guinea (GNF)

(1USD equals 9450 GNF)

In 1995, the first Guinean Franc was launched to replace the CFA franc.

The 500 franc notes are the minor dominance of GNF in circulation. Although the currency was split into cents, it never was issued.

Guinea was supposed to be one of the richest countries in Africa given the precious natural resources in the country.

They include gold, diamond and aluminum, but the currency in the country continues to depreciate against the dollar because of the steady high inflation rate.

Comments