In the vibrant streets of Agege, Lagos, three young men gather outside a betting shop, eagerly awaiting its opening, among them is Bamidele Kayode, a 30-year-old civil engineer.

As they engage in conversation, they ruefully discuss the missed opportunities of their previous night's bets, with their favourite football clubs falling short.

With the doors finally opening, a rush of young people floods into the shop, all chasing the dream of a significant win.

This scene is not unique to Agege; it is repeated all over Nigeria as a growing number of young people turn to betting as a means to make money.

Surprisingly, this trend persists despite the recent resurgence in the nation's capital market, which should logically capture the attention of the younger generation.

However, a comprehensive investigation by Nairametrics reveals a different reality.

The investigation exposes a common thread among young Nigerians: their aversion to investing in the stock market, shaped by their parent's traumatic experiences during the 2008 market crash.

Bamidele Kayode shares his apprehension, recounting how his father lost a substantial portion of his pension during that period. The memory of his father's losses lingers, discouraging him from risking his hard-earned money in the stock market.

Instead, he sees betting as a way to supplement his income.

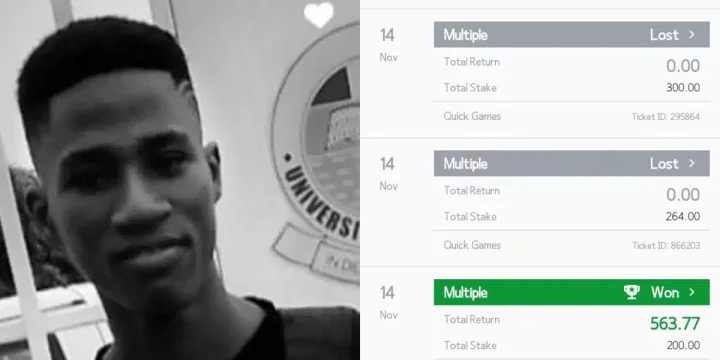

"I can't say that I don't lose money while betting, but I have cashed out more than I lost. I have more confidence in betting than investing in the stock market," he reveals.

Kinsley Chikadibia, a 28-year-old businessman from Ogba, Lagos, echoes Bamidele's sentiments. He believes that the stock market fails to provide quick returns, unlike betting.

"Capital markets don't offer quick money like betting does."

Chikadibia viewed betting as a form of youth empowerment and noted the success stories of many young people who had made money through gambling. To him, betting represents a form of empowerment, as he has witnessed numerous young people amass wealth through gambling.

However, he offers a word of caution, emphasizing the need to avoid falling into the trap of addiction.

Sports betting, in particular, has gained significant traction among Nigerian youths in recent years. Nigeria boasts a preeminent position in Africa, housing the largest number of betting platforms on the continent.

Prominent names in this industry include Bet9ja, 1xBet, Frapapa, BetKing, Parimatch, N1bet, Yangasport, Betway, Betwinner, bet365, and an array of others.

For those averse to physical betting shops, online platforms, encompassing applications, and websites, readily cater to their aspirations.

This exponential growth in the betting sector can be ascribed to several factors, including the burgeoning popularity of European football leagues, the widespread accessibility of mobile devices, and the shifting societal attitudes towards gambling.

As the nation grapples with this pervasive issue, the urgency to address the underlying causes and provide alternative avenues for financial empowerment among young Nigerians becomes increasingly apparent.

At the core of the burgeoning sports betting culture among Nigerian youths lies the profound economic hardship that many young individuals grapple with daily.

For those without stable sources of income, the allure of gambling can be difficult to resist, as it presents itself as an enticing opportunity to swiftly accumulate wealth.

Moreover, the availability of technology has played a pivotal role in the exponential growth of sports betting within Nigerian society.

The ubiquity of smartphones has rendered placing bets easier than ever before. Coupled with the proliferation of betting shops, which now dot urban landscapes, there are now more opportunities for gambling than ever.

In the past, betting was often regarded as a taboo activity, confined to the fringes of society. However, this social stigma has waned significantly.

Presently, individuals from all walks of life, including religious leaders, housewives, and even beggars, can be observed partaking in the act of betting on various sporting events.

The advent of technology has not only made betting more accessible to a broader demographic but has also catalyzed an increase in the volume of bets being placed.

Mobile devices have facilitated seamless bet placements, while convenient payment gateways have expedited the process of depositing funds into betting accounts.

There was reported, a staggering estimate in 2020, indicating that approximately 60 million Nigerians aged between 18 and 40 are actively engaged in sports betting-an unsurprising figure considering the prevalence of poverty and unemployment within the country.

With Nigeria's population surpassing 200 million, it is disheartening to note that 87.5 million individuals live in extreme poverty.

The proliferation of betting shops in urban areas exacerbates the issue of gambling addiction. In some locales, betting shops are virtually omnipresent, with one on practically every street corner.

This saturation makes it all the more arduous for young people to resist the allure of gambling, further entrenching the cycle of temptation and dependency.

Peter Akpan, a house agent, shares his journey into the world of gambling. He explains that his betting habits began at the age of 20 and have persisted since then.

Expressing his lack of confidence in the capital market due to a significant loss, Peter discloses that he bets more when there are sure games.

Although he acknowledges the criticisms surrounding gambling, he highlights the irony of receiving praise when he wins money. "People say that betting is bad, but the same people will love you when you win money," he quips.

Peter's highest win of N500,000 brought him joy as he used the funds to pay his bills. He candidly admits, "Instead of keeping my money, I invest it in betting."

Alex Effiong, an undergraduate at one of Nigeria's universities, shares his perspective on betting as a means of survival.

He emphasizes the unexpected nature of winning, which provides temporary relief from financial struggles.

Alex explains,

"Betting is good for me because winning comes when you least expect it. Sometimes, one might be broke, and it helps to cover one's shame for a while. I have been winning, and it has helped me to upkeep in school in terms of feeding."

Efforts of Regulators to Bring Back the Youths in the Market

The Securities and Exchange Commission recently stated that it is striving to improve market efficiency and make the capital market attractive to the youth, as the demographics of the capital market are currently greying.

Lamido Yuguda, the Director-General of the Commission, highlighted that they will continue to collaborate with various market stakeholders to support the impactful digitalization of the capital market.

Yuguda emphasized the need to address the greying demographics of the capital market through the Revised Capital Market Master Plan.

He explained,

"We are encouraging Capital Market operators to develop the technology. The youths do not want to fill out five-page forms to access the market; they want to pick up their phones and make investments."

As an example, Yuguda mentioned the Commission's support for the innovation by the Issuing House during the MTN IPO in 2022, Chapel Hill Advisory.

This innovation further promoted the benefits of electronic-IPO (e-IPO), resulting in over 100,000 new accounts being opened on the CSCS, with the majority belonging to youths and women - key subsets of the demographic crucial for sustainable growth.

He emphasized their commitment to improving the Know Your Customer process and making other improvements to enhance accessibility for young investors.

The SEC is also introducing fintechs, seeing them as an important gateway for youths to enter the market.

Yuguda stressed that the youths must understand that the capital market is a viable platform for wealth creation, assuring them that the SEC and the market are working on ways to serve them better.

He stated,

"We are striving to improve the way we deliver our products, enhance market efficiency, and make the market attractive to them. Most importantly, we are doing all we can to ensure that investors are adequately protected in the market and can enjoy the benefits of their investments."

Insights from Market Operators

During an exclusive chat with Nairametrics, Mr. Olatunde Amolegbe, the former President of the Chartered Institute of Brokers (CIS) and the Managing Director of Arthur Steven Asset Management Limited, pointed out that one of the major reasons youths have turned to gambling is a lack of adequate orientation.

He added that today's youths are at an age where they are more willing to take risks.

"With the advent of technology, risk-taking in the form of betting has become easier for them. As they grow older, they become more risk-averse and start looking for more traditional asset classes like equities," he said.

Amolegbe noted that the youth's inclination towards betting is also due to a lack of education that would enable them to participate effectively in the equity market.

"You need to learn how to invest; otherwise, you will lose a lot of money. The youths who participate in the market are the ones willing to learn. When the market crashed, those who bought fundamentally strong stocks and were patient enough to wait for their recovery made their money back," Amolegbe explained.

He provided an example of Nestle Food, which was likely bought at around N400 per share in 2008 but now has a price above N1000, emphasizing the importance of patience in the stock market.

Amolegbe emphasized that regulators and other market stakeholders have a significant role to play in educating Nigerian youths and the general public about the benefits of investing in the capital market.

He concluded by stating that while winning in betting may have low odds, the capital market offers the potential for capital gains and dividends, making it a more favourable long-term investment avenue.

Mr. David Adonri, the Executive Vice Chairman of Hicap Securities Limited, responded to the development by highlighting the distinction between gambling and investment.

He acknowledged that it would be challenging to convince gamblers to stop gambling, as it is an addictive and risky endeavour that can result in both significant wins and the loss of wealth.

Adonri recognized that while some youths may prefer the gambling route, others are risk-averse and prioritize calculating their risk exposure to preserve their capital.

Adonri addressed the stock market crash, noting that it was not unique to Nigeria but occurred worldwide. He emphasized that while business ventures involve risks and the possibility of losing money, gambling presents a higher level of risk exposure.

Moving forward, Mr. Moses Igbrude, the National Coordinator of ISAN, suggested that the government should educate young people about the risks of gambling and the benefits of investing in the capital market.

He recommended incorporating such education into school programs, public service announcements, and other outreach efforts.

Igbrude also highlighted the need for capital market regulators to simplify the registration process, provide more educational resources, and make online trading more accessible to young investors.

John Ossai, an independent shareholder, proposed that capital market operators develop products specifically designed for young people.

These products could align with the interests and needs of young investors and offer lower fees and other incentives.

By implementing these measures, Ossai believes that the government and capital market regulators can attract more young people to the capital market and help them achieve more.

Comments